0% Benefit in Kind Tax for Electric Cars Changes from 2020/21

Kuflink Green News! Company drivers for completely ‘Electric Vehicles’ (EV), have to pay 0% Benefit in Kind Tax in 2020/2021. Also, EV’s do not pay any road tax, and get a 100% discount on London’s Congestion Charge.

The UK government is trying to increase the number of Electric Vehicles (EV) on the road while also changing road tax for electric cars. This commitment comes from the efforts to meet climate change targets and enhance the cities’ overall air quality. Therefore, the government will impose a ban on the sales of vehicles (cars & vans) powered by diesel or petrol from 2030. However, there are going to be some exceptions to the ban, such as the plug-in hybrids, and some full hybrids will be sold until 2035.

Along with the ban, the government has also announced a £20 million fund for electric vehicles. This funding will help with the research and development for Electronic vehicles technology innovation. This fund will also be a support for zero-emission emergency vehicles, battery recycling and charging infrastructure.

According to the bank of England, during the course of lockdown, Britons have been able to save more than £100 billion.

One decision that most postponed last year was buying a new car. Despite the pandemic, over 76,000 battery-powered electric vehicles have been sold in the UK. This coming year more people will go with electric cars. And people buying these will be company owners and company drivers because of the EV tax benefits.

This is for information only. Please always seek professional advice before acting.

CHANGING BENEFIT IN KIND

.png?width=627&name=PIE%20CHART%20%20(1).png)

Zero Emission Cars Now Pay 0% BIK

Benefit in Kind

Employees get benefits in kind from their employment, but these are not part of their wages or salary. This covers items like company cars. Benefits in Kind (BIK) is payable on a company or business car if used for private use.

0% Benefit in Kind (BIK) Tax for Electric Cars Changes from 2020/21

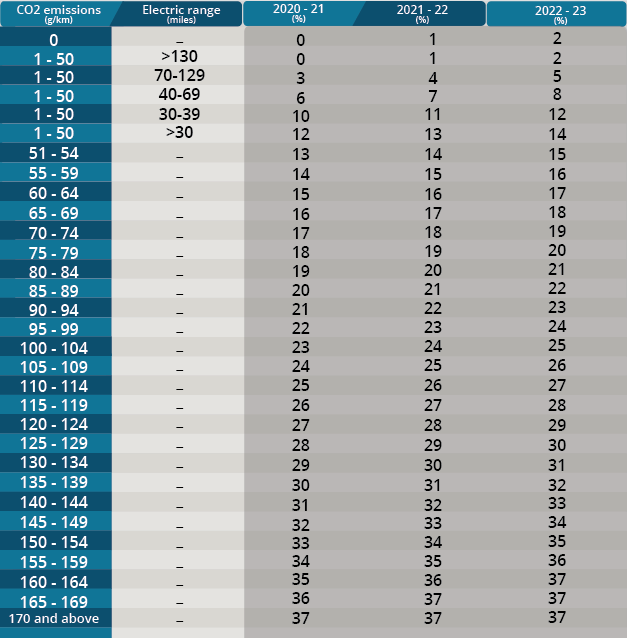

Tax changes made by the government came into effect in 2020/2021, which helps in reducing company car tax bills, especially company drivers. From April 6th, completely electric cars have to pay 0% BIK Tax in 2020/2021. However, they will have to pay 1% in 2021/22 and 2% in 2022/23.

Additionally, the UK government has launched five new Company Car Tax bands for the plug-in hybrid cars, which only emit 1-50g of CO2 per km. This benefits the electric vehicles that drive with zero tailpipe emission. So, there is no better time than the present to change your business vehicles or fleet to electric.

BIK Tax: Electric Cars v Petrol/Diesel Cars

Someone who has got a new BMW petrol-fuelled company car (146g/km of CO2) in April 2020 has to pay a BIK tax of 32%, which will rise to 34% in 2022/23. Similarly, a Nissan Leaf E has 0% BIK tax for the current financial year, which will increase to 1% next year and 2% for the year after. So, if you do that calculation correctly, the BMW will cost you more than £13,000 more in tax over 3-years.

For employers, there are extra benefits. People who earn £100,000 to £125,000, lean towards buying electric company car because, with every £2 that you get over £100,000, you also lose £1 of your personal allowance. This way, your income tax comes to 60%. So, paying 0-2% in BIK tax is better if you are in that position. In addition, the overall cost of the electric car can be written off against the profit you earn in the first year. This cuts your corporation tax as well.

Running Costs : Electric Cars v Petrol/Diesel Cars

However, you don’t have to be a business owner to enjoy the benefit in kind tax on electric cars. These cars also can cost half as much compared to petrol and diesel, depending on the price of electricity and the time you charge the car batteries.

An average UK driver covers 7,400 miles in a year, and on average, the fuel consumption can be around 50 miles per gallon. So, a new car usually gets through 148 gallons of fuel in one year. If the average cost of one gallon is around £5.45, this means the ‘average’ electric car can help you save £400 in a year in fuel cost. Plus, you don’t even have to pay road tax which increases this saving by £150.

Furthermore, electric vehicle drivers get to take advantage of a 100% discount on London’s Congestion Charge. Do you know what that means? You get to save thousands that a daily commuter has to pay!

Even the UK government offers up to £2,500 for buying an Electric Vehicle (cars must cost less than £35,000 – RRP including VAT and Delivery fees) along with £350 for installing a charger at home. (Source: https://www.gov.uk/plug-in-car-van-grants)

Electric Vehicles Excise Duty

Fully EVs don’t have to pay the Excise duty. This encourages the drivers to choose the most environmentally friendly and cleanest vehicles. All cars with less CO2 emission than 75g/km have to pay less road tax in the first year. In addition, fully electric cars get exemption from the expensive car supplement until 2025, March 31st.

Salary Sacrifice on Electric Cars

With salary sacrifice, employees can exchange a part of their salary for non-cash benefits from their employer, like a company car. Salary sacrifice on electric vehicles is a hassle-free and cost-effective way of driving an electric vehicle, whether fully electric or hybrid.

Once you are enlisted on a scheme and have selected an electric car, a monthly payment covering leasing, maintenance and insurance is deducted directly from your salary, before national insurance and income tax. This way, both employer and employee save money. This means the employee will have to pay less tax on a lesser portion of their salary, while the employer has to make fewer National Insurance contributions while supporting more zero-emissions motoring.

Despite your role, salary sacrifice encourages the employees to drive an electric car while saving money at the same time. Just remember that with salary sacrifice, your pay is reduced, which can affect your mortgage applications or maternity pay.

Let’s see, how many types of electric cars are available?

If you don’t want to drive a fully electric car, then there are other environmentally friendly options for you:

- Hybrid Electric Vehicle (HEV): these cars produce their own electricity through a regenerative braking system. Hybrid cars have the capacity to alternate better fossil fuels and rechargeable batteries, depending on the usage.

- Plug-in Hybrid Electric Vehicle (PHEV): these cars are powered by two motors, one is a fuel-injected engine, and the other is an electric vehicle. The fuel engine is deployed when the driver needs more range and power.

- Battery Electric Vehicle (EV): these cars are fully electric and run only on rechargeable batteries. They can be charged either at home or at special charging points across the UK.

The Most Important Question, can you save money?

Want more? You got it. Electric vehicles don’t cost a lot in the long run as you save money on fuel and servicing. An electric car’s capacity is measured in kilowatt-hours which is how much energy the car stores. At public stations, you can get your car recharged for 35p per kWh, and if you charge during off-peak hours at home, then your cost will be as low as 5p per kWh. This means you can charge your car for just a few pounds compared to £30 or more on fuel.

New Bands and Tax Rates For Tax Years 2020 To 2023 For cars first registered from 6 April 2020

What is the Distance Electric Vehicles Can Travel?

The electric car with the longest range is the Tesla S, with a 405 miles range. With this kind of range, you can travel from Leeds to Cornwall with just a few miles left over. The car costs £80,000, but there are other affordable options available in the market.

Top 9 EV Options in the Market

| Car | Range |

| Hyundai Kona Electric | 300 miles |

| Jaguar I-Pace | 292 miles |

| Kia e-Nero | 282 miles |

| Mercedes-Benz EQC | 255 miles |

| Audi e-Tron | 252 miles |

| Renault Zoe R135 | 245 miles |

| Nissan Leaf e+ | 239 miles |

| Hyundai IONIQ | 193 miles |

| Volkswagen e-Golf | 144 miles |

How many charging stations are available across the UK?

According to Zap-Map, there are 15,398 locations with 24,128 charging stations with 41,537 connectors. The number of charging points are increasing rapidly. 7,000 new charging stations were added in 2020. The rapid increase of EV charging points has now outnumbered the 8,500 petrol stations in the UK.

How much does it cost to charge an electric car?

Full charge for a 60 kWh EV can cost up to £9.00. But, if you want to charge your electric car at a public rapid charger station it will cost more than £10.

The cost depends on the location, energy cost, tariff, charge level, battery capacity and charging speed. But one thing is certain, charging an electric car undercuts the cost for a fuel car.

So, is it worth buying an electric car?

There has never been a better time for buying an electric car with the rising fuel prices. Plus, you get to save money in the long run.

This is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

Football and P2P

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/07/Football-and-P2P-_-Peer2Peer-Finance-News.pdf

Below the surface

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/07/Below-the-surface-_-Peer2Peer-Finance-News.pdf

Kuflink releases IFISA wrapper around some select invest deals

Copy the link below if the Read More link expires.

Exchange of Contracts

What does ‘exchange of contracts’ mean?

When two solicitors representing the seller and the buyer swap the signed contracts and the buyer pays the deposit, this is called an exchange of contracts. Once the seller and the buyer exchange contracts, the agreement becomes legally binding, and no party can back out of the deal.

What is the significance of exchanging contracts?

This stage is significant as it marks the point at which both buying and selling parties are legally bound to complete the transaction. It can also set a date for completion and confirms that all the necessary paperwork is in place for completion. After the exchange, if either of the parties pull out of the deal, then there would be penalties.

What happens when you exchange contracts?

In the olden days’ solicitors used to physically meet for exchanging / completing contracts, but that practice is rarely being practised now. This normally happened on a Friday as solicitors would gather their papers and cheques to meet in the other sides firm, to conclude as many conveyancing matters as possible. The closer the other side was, the better. Now things are finalised by conducting verbal agreements over the phone.

During the exchange and completion of contracts, the solicitor reads out the contract over the phone, and that conversation is recorded. The solicitors ensure that the contracts are the same and then send them to each other.

What is completion?

Completion is the final phase of the property purchase/sale process. It happens when the ownership has been transferred successfully to the buyer. And when the seller’s solicitor ensures that the seller is in receipt of whole purchase monies. Upon completion, the buyer gets the vacant possession along with the keys by 1 pm of the completion day. On the completion day, the seller should leave the property by 1 pm, unless otherwise agreed.

Difference between Exchange and Completion

As the exchange word implies, it is an exchange of the contracts between the solicitors which legally binds the seller and the buyer. Completion is the day both parties transfer legal ownership, and the buyer moves in.

The buy/sell transaction is not legally binding until the exchange of contracts. Either party can withdraw before the exchange of contracts but there will be a penalty if it’s done after the exchange.

How long do exchange and completion take?

The exchange of contracts depends on the extent of the property chain but once complete, your solicitor then confirms the legal completion date to you.

The longest part of purchasing a home is an offer being accepted and exchanging contracts, as it can sometimes take several months. In order to speed things up, you have to be well organised, respond to all queries quickly and inform your solicitor and estate agent if you are travelling and unavailable. However, fortunately, when the contracts have been exchanged, the solicitors will agree a completion date.

Generally, people set completion dates for two weeks after exchange. However, this is only a guideline. If the buyer and seller are not in a hurry to move, then they can ask for more time. Sometimes people even complete in less than two weeks. If you set a date after two weeks, it can give you more time to organise everything and change your address information.

Does completion have to be on a Friday?

Most completions happen on a Friday which is a tradition dating back a number of years. People think moving in at the weekend is better as this way they won’t have to take any time off work. Most buyers prefer to move in on the last Friday of the month so their first mortgage payment coincides with their salary every month. However, there is no given rule, guidelines or law for completing on Friday. In fact, on the contrary, it is advised to avoid completing on a Friday.

Why completing on a Friday is not a good idea?

Even though completing on a Friday is the most popular option, there are a few drawbacks to it which you should absolutely know.

- Sometimes, banks money transfer system can get overloaded, which usually happens on the last Friday of the month. So your transfers should happen before Friday as you wouldn’t want to become homeless for a weekend.

- If you move during the week, then you have the advantage of telling your solicitor to resolve any issues occurring during the move.

- Many moves get delayed because the money doesn’t arrive in time. So this is one good reason to avoid completing on a Friday.

- Fridays are known to be peak time for conveyancing frauds, also called the “Friday afternoon scam“. This scam usually targets solicitors’ emails.

- Cybercriminals try to hack into solicitor’s email to divert their client’s funds. They are known to target Friday afternoon as it gives them time to avoid weekend detection.

- Furthermore, if you move and there is a problem, then it’s more difficult to hire anyone to fix it on a Friday or over the weekend.

- Another interesting fact is that most people move on a Friday so they can unpack over the weekend, but the reality is that it’s going to take a bit longer. This means that the moving company will be busier on Fridays compared to weekdays. This will only increase the cost of your move.

Buying and selling a house requires time and patience. You have to be careful and attentive during the whole buy/sell transaction. Make sure to do your own research about exchange and completion so you can decide on a completion date that is the best fit for you.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Kuflink’s New features for June 2021. Stand Up with CTO

Quote for June 2021

“Definiteness of Purpose: Definiteness of Purpose is the starting point of all achievement. Successful people move on their own initiative, but they know where they are going before they start.” – 1 out of 17 Napoleon Hill’s 17 Principles of Success.

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for June 2021

1) We have released IF-ISA wrapper around some of our ISA eligible Select Invest Deals;

2) A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started;

3) We are working on our Open Banking Integration to allow instant top-up through Bank Transfer – testing underway;

4) We have been working on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect development appraisals). We are working with a ‘Royal Institution of Chartered Surveyor’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage to connect this information to our live loans on our platform to provide a time line of any given loan’s risk.

5) We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

6) Portfolio page will also show which Select Invest deals have been put into the ISA wrapper – development underway.

CTO thoughts for June 2021

It is refreshing to have regulators in our sector. Great lessons can be passed on to platforms from past failures. The Regulators, Governing bodies, Independent Auditors, Industry Experts, stakeholders, forums, clients, affiliates, other platforms, advisers, work colleagues, friends, family, etc. all work together to ensure we provide a better service. We are here stronger because of those failings. There are many paths we can follow, and sometimes we get lucky, but generally, it is all of the above who make us better everyday. From the Kuflink team we are grateful to you all.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Back to the Office: Employers Responsibilities

The business sector has suffered a lot because of COVID-19. The biggest challenge for employers and employees has been working from home. While this is something that is not new but it wasn’t being practised on a huge level. However, remote working or working from home became our new norm.

The government has been providing constant guidelines during the pandemic to ensure the safety of employees. For instance, since march, businesses have been getting updates on how to keep their workplaces secure against the threat of the virus. So, now that we all are set to go back to the offices, as employers, we need to aware of the guidelines in place.

The UK government has decided to remove all legal limitation on social contact now that more than half the population has gotten vaccination. However, the variants of this virus may hinder governments plan, but we are optimistic that on 21 June, things go back to (some sort of) normal.

Keeping in mind the government regulations, there are four things that employers must do to ensure the health and safety of their employees.

Business Travel: Protect Your Team

This not only negatively affects the employee but also the company. After offices start functioning as before, many employers may be worried about potential compensation claims from staff who travel for business and contract COVID-19. These claims can be hard to pursue successfully.

As employers, we can protect our employees by:

- Conducting risk assessments for all business trips

- Documenting the steps necessary for safe travel

- Making sure the staff only travel with reputable operators

- Covering the cost for safe and clean hotels

- Empowering the employees with the right information about where they are travelling and whom they are meeting up with.

Know Where You Stand as Employer According to Law

There are different health and safety duties that employers are responsible for under the law. These duties applied before COVID-19, during the pandemic and will continue after it.

Employers must do the following:

- Take care of employees’ health and safety

- Provide a safe space and system for work

- In some circumstances, be liable for the negligence of employees

- Ensure where you stand as an employer

Establish Extra Safety Measures

Many workers will be concerned and nervous about returning to offices in June. Most will be worried about catching the Coronavirus.

So, as an employer, you need to:

- Get to know your workers’ concerns about returning to the office

- Take necessary precautions to make your team feel safe at work

- Reassure them by explaining how you have made the office COVID-secure

Have a Written Policy

As an employer, we are responsible for having a written health and safety policy. This is a legal duty that every workplace must implement to have a COVID-secure working environment.

Furthermore, as an employer, it is our duty to bring the written policy to the attention of all employees according to the health and safety at Work Act 1974.

A recent study has revealed that 29% of those who have suffered from COVID-19 develop Acute Respiratory Distress Syndrome (ARDS). It is thought that a third of coronavirus survivors may never fully return to work. This means that we should make sure that there is a personalised back to work plan that offers flexibility to employees in both the timing and structure of their working day.

What should be done for employees affected by the COVID-19?

As an employer, you should consider the following:

- Make sure all employees know the symptoms of the Coronavirus. They know what actions to take if they experience sickness, their sick pay entitlement and other necessary information; this all should be clear.

- For workers still based in their workplace, ensure that they follow the social distancing rules everywhere, including the rest areas. Always follow governments update of shift patterns to avoid peak travelling time and to lessen face-to-face contacts.

- Ensure everyone in the office has up to date knowledge and equipment to manage cleanliness at the workspace for post-infection management and prevention.

- Be aware of those classed as vulnerable to make sure the right actions are taken.

- Keep facilities easily available for employees to wash their hands regularly with soap. If possible also provide a hand sanitiser to encourage staff to use them at their workstations.

At Kuflink peer to peer lending, we are excited to work alongside the team in the office. However, we are putting in place every necessary step to ensure the security of our employees.