UK Crowdfunding Investments P2P Lending Statistics – April 2021

Copy the link below to see Apr 2021 Statistics.

https://www.kuflink.com/wp-content/uploads/2021/05/Screenshot-2021-05-20-at-13.57.22.png

Shifting sands

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/05/Shifting-sands-_-Peer2Peer-Finance-News.pdf

4th Way backs Kuflink and reaffirms top rating after ‘auditor headache’

Copy the link below if the Read More link expires.

Kuflink Enacts Changes In Response To Auditor Concerns On Governance

A profitable property lending record since 2011 & highly satisfactory lending result.

Kuflink 5 Year Auto & IFISA received an Exceptional 3/3 4thWay PLUS Rating

Kuflink’s New features for May 2021. Stand Up with CTO

Quote for May 2021

“If we human beings rely only on material development, we can’t be sure of a positive outcome. Employing technology motivated by anger and hatred is likely to be destructive. It will only be beneficial if we seek the welfare of all beings. Human beings are the only species with the potential to destroy the world. Because of the risks of unrestrained desire and greed we need to cultivate contentment and simplicity” – Dalai Lama

Bit of fun for May 2021

Please view our teaser video showing the NEW IF-ISA wrapper offering around some of our Select Invest Deals.

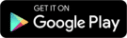

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for May 2021

1) You can now open each new Select Invest deal on separate tabs of your browser in the Market place (Secondary Market);

2) All loan tranches and tiers to show other tranched and tiered loans under each related Select Invest Loan. This is now live;

3) We are working on showing updated images and information of our Development Loans – development has started – release date in the next few weeks;

4) We have started works on providing an IF-ISA wrapper around some of our Select Invest Deals. Code has been released on the platform and is going through final testing. The release will be any day now;

5) Insights section is being enhanced to show other useful information to those keen on property investments. We will be showing information per region and maps never seen before showing specific property type price performances within regions;

6) IF-ISA Transfer IN Sign up process to be digitised is now ready for end to end development and release in the next few days;

7) Connect to our Open Banking App, which then means we do not require an uploaded bank statement, and gives the ability to make bank transfers in real-time – development is ongoing;

8) A New segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started – release in the next few weeks;

9) Works have started on Upgrading our NEW Dashboard. New live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display.

10) Proprietary loan management system has been linked to the Invest platform showing real-time borrower loan information tabulated, and charts showing the breakdown by property type, 1st charge versus 2nd charge, breakdown by Gross LTV, geographical split and historic lending Volumes (Statistics page).

11) We will be working on New Videos and specific pages (showing fast-forwarded investments with different results) to ensure clients get a further enhanced understanding of all of the risks and rewards in Peer to Peer investing. This will be implemented into the onboarding flow prior to possibly FCA introducing this next year.

12) Introduced the Kuflink.com footer with Products, Guides, About us, Blogs and Work with us links to the invest platform footer;

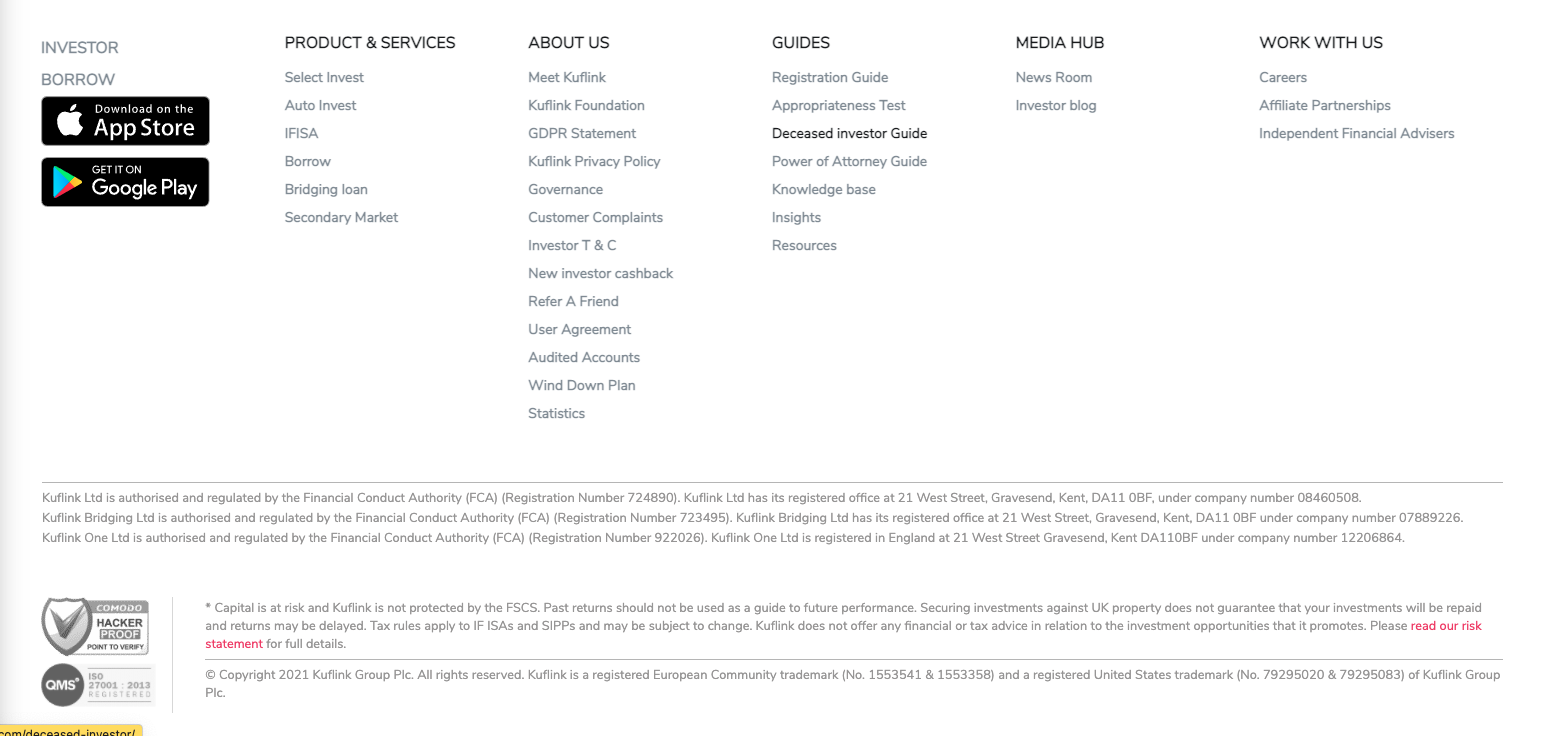

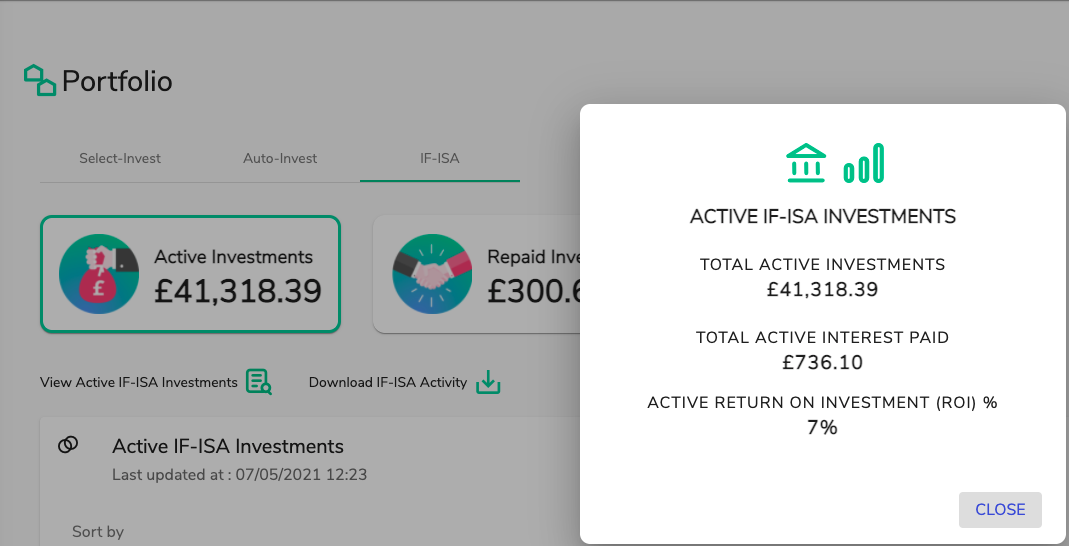

13) View Active Investments information has been put into a new section to enable the speed of the mobile apps and desktop versions to increase. This will also appear on the dashboard in the future. But please click on the links labelled (View Active IF-ISA Investments) in the Portfolio section. There are three links in Select Invest, Auto-Invest and IF-ISA as shown in the example below;

14) Please Download our Mobile APP using the links below; and

15) Much more coming.

CTO thoughts for May 2021

“Criticism may not be agreeable, but it is necessary. It fulfils the same function as pain in the human body. It calls attention to an unhealthy state of things.” – Winston Churchill.

This is why we went against the grain when it came to adopting our own Kuflink Default definition of one calendar month rather than the FCA Default definition of six calendar months. We react much quicker. We get in contact with borrowers many months before things go into one month default. Interestingly, our debt repayment during covid was substantial. This is mainly due to the Collections team, Underwriting and Credit committee decisions.

KUFLINK DEFAULT RATE.

A loan defaults when it is one calendar month past a missed payment, with this payment still outstanding. This may be a monthly servicing payment or the full repayment at the end of the term.

FCA DEFAULT DEFINITION

A loan defaults when the Borrower is past the contractual payment due date by more than 180 days. Which is approximately six calendar months.

We’ve had an amazing ISA season and our product development is expanding, especially in regards to the New offering with ISA wrapper around select invest allowing users to self select their opportunities. There are new products for Borrowers and Investors on the horizon (watch this space).

We continue to invite new users to the platform and strive to simplify the onboarding process to ensure clients understand risk and reward before investing. 12 months into the pandemic, the tech team’s contribution and dedication has been exemplary. The team’s tenacity is commendable whilst working remotely across various time zones. It’s been a massive effort by all.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

How to transfer an ISA?

The ISA transfer is quite simple; however, some rules have to be followed to ensure that your money doesn’t lose the tax-free status. Let’s learn about what an ISA transfer is and the things you must consider before transferring.

What is an ISA transfer and how it works?

With an ISA transfer, you can transfer your funds from your existing ISA provider to a new one without compromising the tax-free status for your money. If you transfer your ISA money by withdrawing it first and then resubscribing, it will be a new subscription, and you will lose the tax-free status.

For instance, if you subscribe £4,000 into a cash ISA in 2021/2022 and have not subscribed to any other ISA, then if you were to transfer this money into an Innovative Finance ISA, it will not count towards your annual ISA allowance again, and you would still have £16,000 from your annual allowance of £20,000.

So, the process of ISA transfer can be helpful in maximising the ISA returns. Typically, you can transfer an ISA to a different product in the ISA family or to a different provider.

Things to consider before transferring ISA

You are free to transfer your ISA as many times as you want

The rule for an ISA is that you can only invest in one of each ISA type each tax year. But you can transfer your ISA as many times as you like. Technically transfers don’t count as paying into an ISA. So, if you find a better interest rate somewhere else, you can transfer your ISA. If you have a notice or fixed cash ISA, you’ll need to check whether transferring out your ISA will incur a penalty. Also, it’s worth noting that you can transfer your ISA savings from the previous year to a better account, and you can open a new one for the existing tax year simultaneously.

You can transfer money from one ISA type to another if the provider accepts transfer ins.

Money subscribed to a cash ISA can be transferred to another cash ISA account or into a stocks & shares ISA, and similarly, funds in stocks & shares can be transferred to a cash ISA. You can also do the same with IFISAs and Lifetime ISAs, but the procedure might be complex due to the specific rules of these ISAs.

Don’t withdraw your funds, or you will lose the tax-free status.

Never withdraw money from your ISA to reinvest into another ISA. The key is to transfer the ISA. Withdrawing money instead of transferring means you will lose the tax-free wrapper. If you have several years’ worth of savings in a cash ISA, you cannot put it all into a new ISA because of the annual limit. You MUST transfer the ISA account itself or the money in it, or you are effectively starting over.

Transfer the amount you want to – there is no limit.

You can transfer all the money in your current year’s account, or you can transfer a part of your previous year’s funds to a new ISA account. The usual pay-in limit does not govern the ISA transfers. So, it is up to you to transfer the whole amount or a part of it. Remember that not all ISA providers allow partial transfers, so make sure you check with your provider.

- A cash ISA transfer is an easy process

The ISA transfer process is simple. Once you have done your research and found a better interest rate, make sure the provider allows transfers. All you have to do is open the new ISA account and complete the transfer form with the new provider. After that, it is all in the hands of the providers. They are responsible for completing the whole transfer process.

Why should you try ISA transfer?

You should try an ISA transfer for the following reasons:

- To get better interest rate and returns

- To gather your funds for easy management

- To diversify into different ISA types to spread the risk

What happens to an ISA if I move from the UK

Pertaining to applying for a Kuflink IF-ISA, you must confirm that you are a resident in the United Kingdom for tax purposes or, if not so resident, either perform duties which, by virtue of Section 28 of Income Tax (Earnings & Pensions) Act 2003 (Crown employees serving overseas), are treated as being performed in the United Kingdom, or you are married to or in a civil partnership with a person who performs such duties. You must inform Kuflink if you cease to be so resident or to perform such duties or be married to, or in a civil partnership with, a person who performs such duties.

If you are no longer a resident of the UK for TAX purposes, you can no longer add any further money to your IF-ISA or open a new IF-ISA.

However, you can keep your existing IF-ISA’s open and will still get UK tax relief on money and investments held in it. You can transfer an IF-ISA to another provider even if you are not a resident in the UK. You can pay into the Kuflink IF-ISA again when you return and become a UK resident.

When you are no longer a resident, then you may be subject to the tax regime of the country you are now resident in and may have to pay tax on UK ISA’s. Please seek independent financial advice.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

How to become a P2P investor?

With peer to peer lending, investors can earn better returns. Generally, they can earn anywhere between 2% and 8% depending on the amount they invest and the term they select. In addition, peer to peer lending allows you to invest in a diversified portfolio by putting your funds into different investments.

Just like other investments, P2P can be risky*. There is a chance of borrowers defaulting thereby causing delays in your investment return. Also, P2P lending is not protected by the FSCS, which means you may lose your entire investment.

Investing in peer to peer lending is very easy. All you have to do is find the right provider that matches your investment goals. Once you have found your match, you just have to sign up as a lender and transfer money. You are good to go!

To show you how easy the P2P investing process is, let’s look at how you can become an investor at Kuflink. All loans are secured on a property (1st or 2nd charge)*.

The on-boarding process

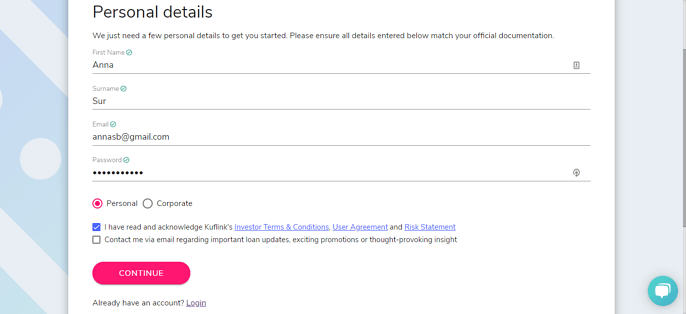

Signup – Add your personal details

Information needed for sign up- You need to upload a copy of your valid photo ID which could be your Passport, Driving Licence or National ID card.

- For additional security, you will also have to take a photo or video of yourself.

- You need to have a UK bank account to create a Kuflink account.

These checks are solely to verify your identity, are not a credit check and will not be visible on your credit record.

-

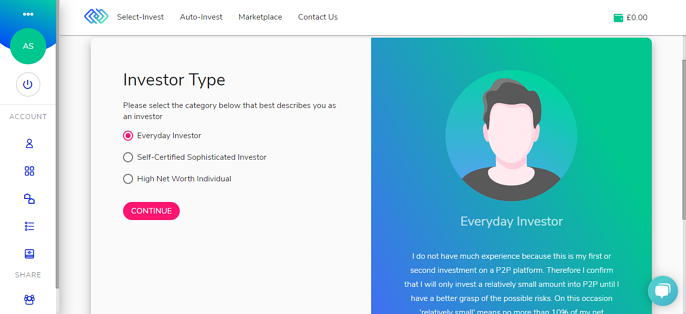

Next Step – ‘Appropriateness test’ to start investing

The Appropriateness Test is a Multiple Choice Test that every investor must pass before Investing in a peer to peer Agreement. This is to ensure the Investor understands the risks and rewards of investing through a P2P platfom.

The Appropriateness Test is a Multiple Choice Test that every investor must pass before Investing in a peer to peer Agreement. This is to ensure the Investor understands the risks and rewards of investing through a P2P platfom. -

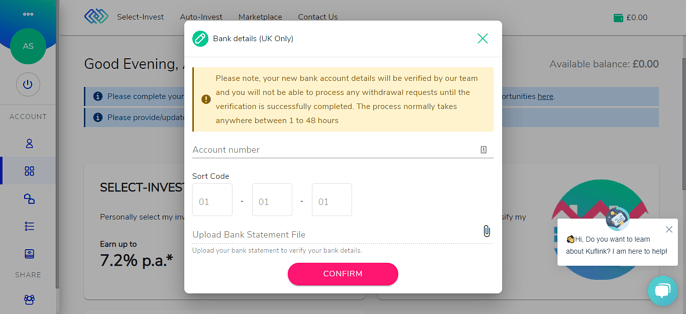

Add your ‘Banks details’

Every Investor must upload their account number, sort code and a bank statement to verify the accuracy of the details. This is to ensure that when funds are returned, they go to the right account registered to the investor, hence, we request a bank statement showing your name, account number and sort code. -

Select a product and start making money

With Kuflink, as a New Investor, you must start by investing a minimum amount of £100 into any Kuflink Product.

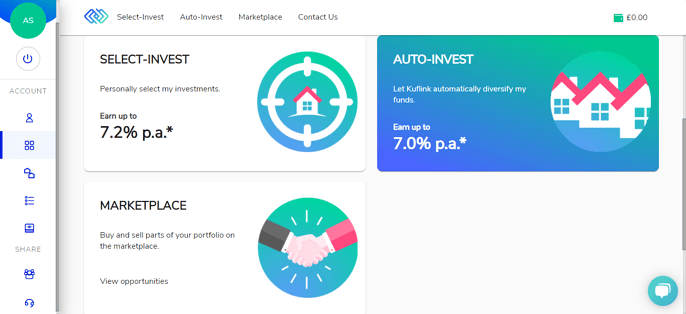

Kuflink Investment Products

Kuflink offers three investment products to its investors, including:

- Select Invest – you can choose and allocate your money across different loans secured on property (1st or 2nd charge)*

Kuflink Select-Invest option allows you to manage your portfolio of loans. When investing with Kuflink, you can select to have your interest compounded. This means your interest will not be paid until maturity, and you get to earn more on your funds. You also have the option of getting interest paid on the first working day of every month.

If you ever want to exit from an investment early, you can list your loan on the Kuflink secondary market for sale. There will be a 0.25% seller’s fee, payable when your investment gets sold. If another investor buys your loan, you will get your capital and any due interest for that month.

- Auto Invest – your funds are diversified across multiple loans secured on properties (1st and/or 2nd charge)*

With Auto-Invest, your investments are diversified across a pool of secured P2P loans. When the loans mature, they will be removed from the pool, and when new suitable loans become available, they are added to the investment pool.

You can invest in either 1, 3, or 5-year periods, where you will be tied to the investment throughout the term of the loan, and you cannot exit early.

- Innovative Finance ISA (IFISA) – diversify your money across multiple loans secured on properties (1st and/or 2nd charge)* with an ISA wrapper

Just like Auto-Invest, IFISA automatically diversifies across multiple loans secured against UK property with an ISA wrapper. The Innovative Finance ISA allows lenders to put part of, or their entire annual ISA allowance in to earn interest tax-free on the money lent through an FCA-regulated P2P platform (ISA Manager approved). You can start investing with IFISA for as little as £100.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.