Who can Invest in an IFISA?

What Is An IFISA?

With the increasing popularity of alternative finance, the UK government introduced Innovative Finance ISAs (IFISA) on 6th April 2016. The purpose was to provide investors with an alternative asset class and a way to diversify their investment portfolios.

The IFISA enables investors to invest in Peer to Peer (P2P) loans and receive interest in a tax-free wrapper. It means that any interest you earn through P2P loans will not be subject to tax, and will not count towards your saving allowance.

However, there is a limit on how much you can subscribe to ISAs every tax year, known as the Annual ISA limit. Currently, the annual allowance limit in the UK is £20,000. You can either fully deploy this allowance in an IFISA or spread it across different types of ISAs.

In addition, you can also transfer funds from cash ISAs, stocks and shares ISAs into IFISAs. Your previous year’s ISAs do not count towards the current year’s allowance, so it provides you with a great opportunity to explore P2P lending.

Who Can Open An IFISA?

To open an IFISA account, you must meet some requirements including:

- You must be of age 18 or over

- You should be a resident of the UK

- A crown servant, spouse, or civil partner if you are not a UK resident.

How Do IFISA Transfers Work?

The rules for transferring your ISA savings to Innovative Finance ISAs are the same as those governing you for transferring to cash or stocks and shares ISAs. You can open only one IFISA account each tax year. However, you can transfer funds from your cash ISA or stocks and shares ISA to an Innovative Finance ISA.

You can transfer funds by following simple steps:

- If you want to transfer cash from your current tax year’s cash or stocks and shares ISAs, you have to transfer the full amount.

- From your previous year’s ISAs, you can transfer as little as you want to, and it will not affect your current year’s annual allowance.

- You need to fill out a transfer form given to you by the innovative finance ISA provider you choose to transfer funds to.

- You should not withdraw cash from other ISAs to transfer because it can impact your current annual allowance.

- You can transfer cash, if you have stocks and shares, you have to sell them, and then the cash will be used to invest in P2P loans.

How Many ISAs Can You Have?

You can have different ISAs, but you can open only one IFISA account per tax year. As of the 2022-23 tax year, you can collectively invest up to £20,000 in all ISAs. It is your choice whether you want to spread this investment across Cash ISAs, stocks and shares ISAs, Lifetime and Innovative Finance ISAs, or invest all money in a single type of ISA.

By opening an IFISA account with Kuflink, you can start investing with just £100 and earn up to 9.13% (compounded rate of return) gross interest per annum.*

Why Choose Kuflink IFISA?

Kuflink provides an opportunity to invest in property-backed loans* and enjoy the benefits of tax-free returns that come with ISAs.

1) Auto Invest IF-ISA, which allows you to create a diversified portfolio and spread your investment and risk across multiple property-backed loans*. In addition, you can choose loan terms and earn interest in relation to it. Kuflink’s Auto-Invest IF-ISA comes with the following features:

- Up to 7.9%* gross interest per annum.

- Blended LTV & LTGDV circa 65%.

- Flexible terms of 1,3, and 5 years.

- You can get started with £100.

- Entire Pool secured against UK Property* (1st & 2nd legal charges).

- Diversify your funds across multiple secured loans*.

- Tax-efficient Innovative Finance ISA wrapper

2) Select Invest IF-ISA – where you can allocate your funds across any secured loan* and get the tax free benefits you do in Auto Invest IF-ISA.

- Up to 9.8%* gross interest per annum.

- Secured against UK Property* (1st & 2nd legal charges).

- Secondary market available for Select Invest IF-ISA investments (T&C’s apply)

- ISA Previous and ISA current wallets available

- Tax-efficient Innovative Finance ISA wrapper

Interested in learning more? Visit https://www.kuflink.com/innovative-finance-isa/ to begin.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Property Trends Investors Must Know

From the start of 2022, we have seen the resilience and strength of the UK property market. The property prices and rents are increasing exponentially in some areas across the country. As a result, property investors are looking for new investment opportunities after seeing this post-pandemic boom in the real estate market. So, let’s look at four property trends in 2022 for smart investors.

Increase in prices, but ease in momentum

The property experts expect the property prices to increase but not with a speed witnessed in 2021. According to Rightmove’s prediction, the frantic pandemic will lower this year and return closer to normal1. They expect the current national asking price of the market, £342,401 to rise by 5%, which means there will be an increase of around £17,000 in 20222.

The Private Rental Market Will Continue to Display Positive Growth

The UK rental market is expected to be strong and grow continuously. According to a report by Zoopla, the rental market sector is expected to rise by 4.5% in 2022. Their UK Rental Market Report shows that in the year 2021 the rents were up by 4.6%, after a rise of 3% due to increasing demand in city centres. The rent increase has hit a 13 year high because city centres’ rental property demand has increased3. About a third of millennials are expected to live in rental properties their entire lives.

More focus on Sustainable Eco Living

With the increase in climate change, we could see homeowners setting targets to improve the energy performance of their homes this year. In the UK, homes caused up to 15% of greenhouse gas emissions in 2018. The government recognises that if they have to meet Net Zero, there is a great need to eliminate emissions from the housing stocks by 2050. Eventually, the government introduced its Green Finance strategy in July 2019, intending to grow green finance products and increase home energy performance improvements.

The Midlands and the North Will Continue to Outperform

We also expect that Prime Minister’s Levelling Up policies will continue closing the north-south divide. The JLL’s 2022-2026 UK residential forecast report describes the top-performing cities and regions, depending on economic, social and market factors, thus providing the most accurate forecast4. West Midlands is expected to lead the UK’s house prices with 7% growth during this period that is 2% higher than the national average. Southwest, Scotland and Yorkshire are also expected to see similar growth. However, the slowest growth is expected to see in London properties that is only 3%5.

As a whole, we can say that the UK property market trends will remain buoyant in 2022 due to pandemic related trends and structural shortage of housing. As a result, the market is expected to be more stable and less frantic than in 2021.

Moreover, this renovated trust in the resilience of UK property will lead to the growth of the market further and result in more investment and development activities.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

1The pandemic property market will return to ‘closer to normal’ in 2022

2 UK Property Market Forecasts 2022

3 Rent increases hit 13-year high as demand in major cities doubles

Investing to Stay Ahead of Inflation

Earning money is hard, and if you think your money isn’t going as far as it used to, you are not wrong. However, the increase in prices across the UK economy is real. Therefore, you need to understand what it means for you and take steps to stay ahead of inflation.

All of the below is for information only. Please always seek professional advice before acting.

So, what is inflation?

Inflation is a gradual hike in prices across an economy, and it is usually caused by an increase in consumer demand or production costs. This rise in prices is felt widely across goods and services, along with the products included in our weekly groceries and the energy we use at home. Therefore, it is called a rise in the cost of living.

The most common measurement of inflation rate in the UK is the Retail Price Index (RPI), which can be used to calculate such things as rail ticket prices or mobile phone contract prices. However, the different ways these indices track change in pricing and the items in the basket of goods can vary.

You must know that the Pound value does not follow inflation in the UK, which means that while the prices increase, your money falls behind in real terms.

How does inflation affect investments?

Effects of inflation can be negligible in the short term, but they significantly affect the real value of your money and investments over time. For instance, if you owned £10 twenty-one years ago, the goods you could have bought would now cost around £17.24 and this shows how its purchasing power has been decreased by 42% due to inflation, equal to 2.8% a year.

While inflation over the next twenty years may rise more slowly than it has in the past, a low inflation rate can build up or compound to erode the actual value of money over time unless you plan to beat it.

Let’s get to some serious business of investing our money to stay ahead of inflation.

Best Investments to Stay Ahead of Inflation

If you want to protect your wealth, you need to invest, keeping in mind inflation and selecting assets that can keep pace with rising prices naturally. Such assets mainly include real, tangible assets, or investments that can pay a variable interest rate and increase over time.

Unfortunately, you still can lose money because of inflation with a high-interest rate since high-interest rates are usually paired with high inflation rates. The Bank of England uses it as a tool to cool a steep rise in the cost of living. Let’s review some inflation-proof investments so you can protect your wealth.

Equities

Investments that are linked to the stock market have proven to beat the impact of inflation when held consistently and long-term, delivering returns ahead of prices, although past performances shouldn’t be a guide for future investments. As prices increase, the profits and revenues of the companies selling services and goods increase, raising both the value of their shares and, in some cases, the payments made to shareholders.

Some equities, especially those in specific sectors, have shown an even better record in terms of performance in the past and have usually outperformed the markets themselves. These growth stocks can provide even better opportunities for people looking to boost their wealth to stay ahead of inflation. However, fluctuations in the prices can mean they are high risk.

Real Estate (or property investments)

Real estate investment is a very common and popular option for investors because of its accurate and reliable nature. However, it can be a complicated asset because investors need a high initial cost. Therefore, retail investors can access property indirectly by collective property funds while gaining many of the advantages experienced by investment landlords.

Investing money in real estate can be an excellent choice to keep up with inflation due to investment returns and the asset involved in this investment. Usually, investors can benefit from the properties in two ways: rental income from the tenants and the increase in property value at the time of sale. Generally, the property’s value has increased more than the inflation rate as the demand for the property increases, which also causes a cumulative effect on the rent that investors can generate. Such an increase in value makes property investment one of the best investments to keep up with inflation and a source of income generation in the long run.

In some recent years, investors have been facing some difficulties in gaining access to collective property funds. So you need to understand the restrictions and get advice from real estate experts.

Peer to Peer Lending

With rising inflation, unless you take some risks with your money, you might be losing money. However, while traditionally shares were thought of as the only way to seek higher returns, Peer to Peer lending has proven to become more popular among people wanting to earn profit without having to dip their toe in the stock market or property market.

For instance, Kuflink offers upto 9.13%* gross per annum for people who lend their money in Peer to Peer loans secured against UK Property*.

Furthermore, you can reduce the risk by diversifying your investments across loans using Pool products.

Bonds

Bonds are usually considered safer and less profitable assets for investments. However, they can outperform inflation in the long run. In the last two decades, the interest by government bonds has maintained reasonable value compared to inflation. But, in recent years, bond yields have been lower, and they might not rise to the previous levels.

There are other types of bonds that provide high yields. However, the index-linked bonds usually provide an effective hedge against inflation in the long term. Index-linked bonds work because they offer variable interest rates that change with inflation, which is generally linked to an inflation index like CPI or RPI. But, keep in mind that these bonds are sensitive to change in interest rates and their prices fluctuate depending on the current economic outlook.

Commodities

The word commodity is usually used for precious metals and raw materials such as timber, copper, and gold, which are used to produce goods worldwide. However, it can also be used for some consumables that include gas and energy. The price of commodities is highly influenced by the demand and production of commodities all over the world. Thus, we can say that it directly links the prices paid by consumers for services and products they need.

Commodities offer a great hedge against inflation and are useful to diversify investment portfolios. Thanks to the Exchange Traded Funds (ETFs), it is easier to track the price of different commodities accurately.

All Investments Are Not The Same

As we have described, there are some assets that can help you to overcome the effect of inflation but there are also many other ways to invest, and you should keep in mind that all investments do not behave in the same manner. All the investments have their benefits and drawbacks. It is essential to build a diversified investment portfolio to get the benefits of each investment while reducing the amount of risk on your capital.

Although investing for inflation is vital to grow your money and maintain its value, it should not out weigh your long term investment objectives. Of course, it is also imperative to hold an easily accessible cash buffer, but you should always have a clear objective and investment strategy in your priorities.

All of the above is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

What We Learned From Kuflink’s First Profitable Accounts

Kuflink* has just reported its first ever profit of about £400,000, off the back of real earnings of about £3 million, for 2021.

Which P2P Lending Sites Are Profitable?

The Kuflink group of companies made its first profit of around £400,000 in 2021, according to its accounts, on revenue of more than £3 million. Independent auditors are MHA MacIntyre Hudson.

Kuflink’s new features for January 2022

From the IT team, a very happy new year to you all. We’ve hit the ground running and are looking forward to a productive, effective and exciting 2022 for our platform.

Quote for January 2022

“Maintenance of sound health: follow work with play, mental effort with physical, eating with fasting, seriousness with humour, and you will be with sound health and happiness.” – 9 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s new or on its way to the Kuflink Platform for January 2022

1) Released! View which deals are compounded

You can now see, at a glance, which deals you have compounded and which you have not in your portfolio. Simply head to your wallet to view.

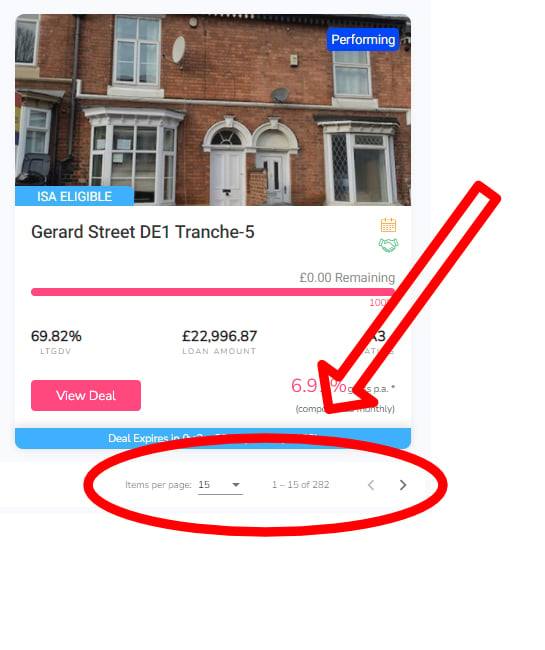

2) Released! Items Per Page is set for life

It’s a small thing – but one of our investors asked, and we were happy to oblige. We’ve included the cookie for the number of items per page that you choose – so next time you log in, your choice will remain! Look on the bottom right of the deals list

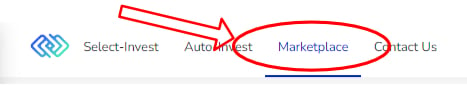

3) Released! Buy and sell IF-ISA on the secondary market.

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

4) Improvements! Behind the scenes.

Each month, the majority of our work is behind the scenes – improving efficiency, security, and setting up processes for future large releases. Though you may not see large changes on the front end (the bit you use), we’ve implemented an awful lot of changes on the back end, ready for an exciting 2022.

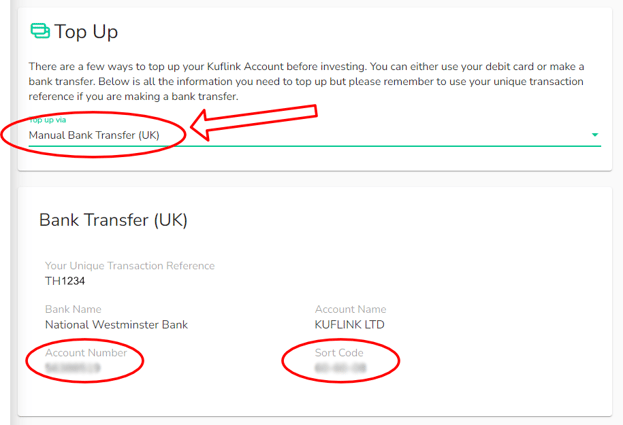

5) Don’t forget! Our banking details have changed.

We’ve mentioned it in a few other places, but worth reiterating here also; if you send us money via direct transfer or standing order, our bank details have changed. We’ve put in place some reminders around our platform, but you can find out more about the change here.

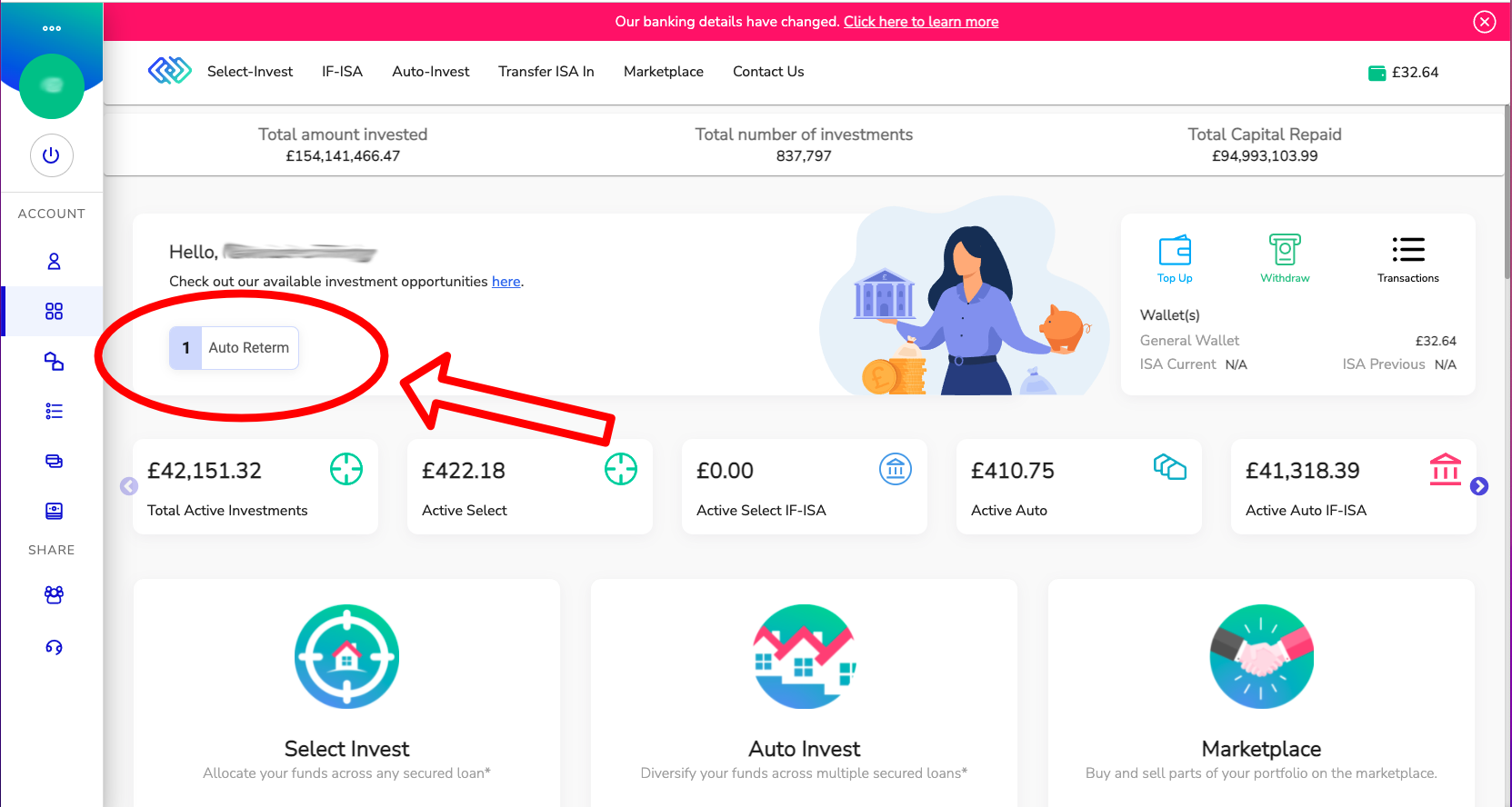

6) Released! New Dashboard Totals

Due to client requests, we have just released a new “Total Investments” figure and a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals.

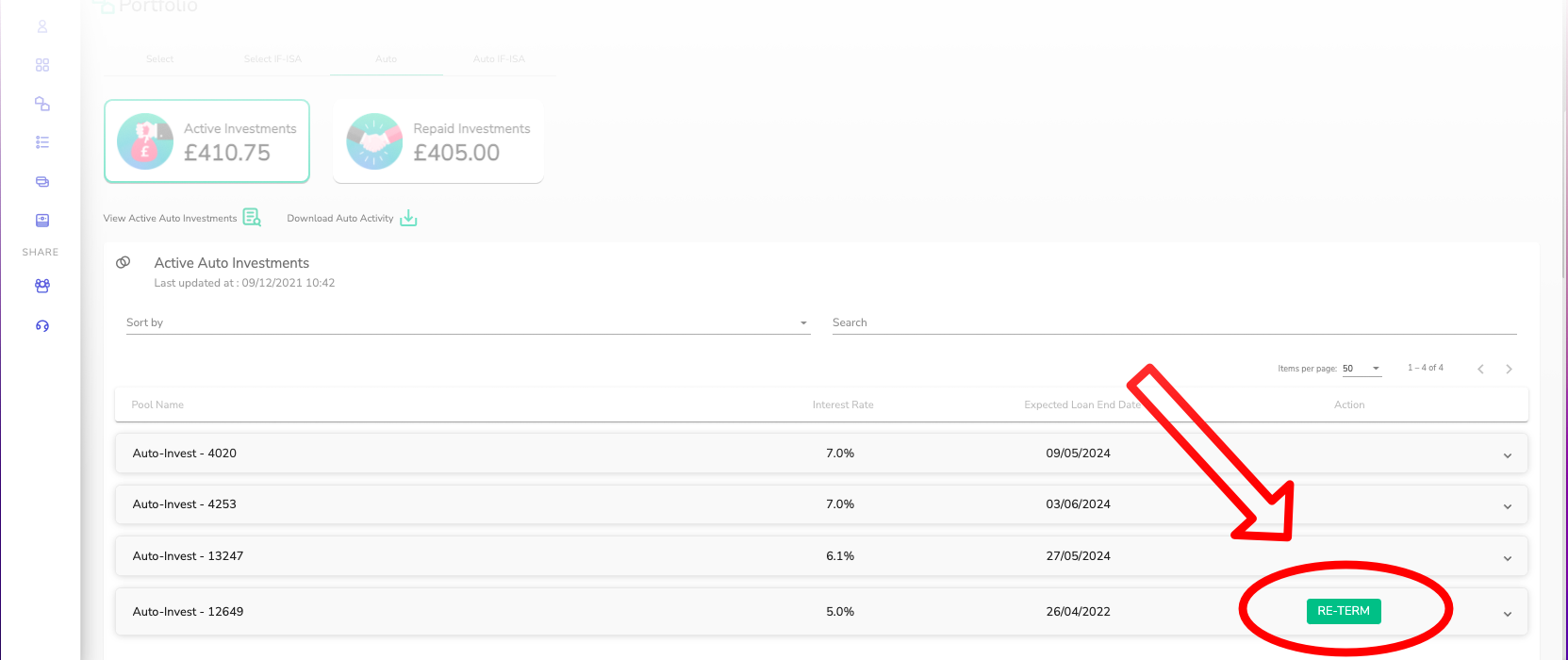

7) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early, and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

8) Upgraded! The Audited Accounts page has had a face-lift.

We just released our latest, 5th year of Independently Audited accounts for the platform, in January 2022 for period-ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

9) Coming Soon! A survey to ensure Kuflink is delivering good outcomes for our clients.

We welcome and have already started work on ensuring the New Consumer Duty, which will be applied in July 2022 by the Financial Conduct Authority, is established within the Firm. Part of this work will be a new survey sent to clients where they can send us feedback. We have already implemented internal control framework changes to ensure this is engrained throughout Kuflink.

CTO thoughts for January 2022

With a clear plan of improvements already underway for 2022, we’re looking forward to making something better every day. Whether that’s behind the scenes, whether that’s front of house, my whole team is geared towards making your Kuflink experience better each time you visit.

With that in mind, if you have suggestions or comments on what you’d like to see on the platform, we’d always like to hear from you. 2022 is packed full – improving security even further with 2MFA (multi-factor authentication), expanding our product range to include SIPP (Self-Invested Personal Pension) along with a whole host of subtle improvements to give you a wonderful user experience. We know you’ll find value in the improvements, and they’ll aid your journey to financial freedom.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Smart New Year’s Resolutions To Save Money

Christmas is a big event that can wash out your finances and cause a great impact on your budget. If the holiday season hit you harder than you hoped, we have some tips that will help get you back on track.

January is the best time of year for bank account replenishment and eliminating last year’s bad money habits.

All the below is for information purposes only. Please always seek professional advice before acting.

If your resolution for the new year is to save money, the following are some ways to do it:

Make it fun! Take on a Money Saving Challenge

It’s easy to think of saving money but actually doing it can be hard. However, if you think challenges are fun, there are some money-saving tips that can make all of this a lot easier – and you should find yourself doing well out of completing these challenges.

The first challenge for the new year is the 1p saving challenge. As the name suggests, you have to put away a single penny. On the next day, you have to put away 2p, 3p on the third day and so on. Using this way by the end of the year you can save a total of £667.95.

Don’t worry if you’ve not started yet, and it’s already into the new year. You can easily catch up by adding totals of the days you missed – so if you begin on Wednesday 20th January, simply add £2.10 on your first day, then resume the challenge as normal on 21st January, when you’d save 21p.

Save money on bills in the January sales

You can see that standard retailers cut the prices at the start of the year and you can also get some marvellous deals on your bills in January sales.

Some great deals are offered on broadband connections and you do not need to worry even if you haven’t renewed your contract. At the start of the new year network providers are keen to get maximum customers on board so if you find a good deal, it will be worth asking your provider if they can buy out your existing contract.

The same is in the case of mobile phone contracts. Even if your end date is way off, there is no harm in calling a new network and asking them to buy you out of your current contract.

However, if the new provider does not agree to buy you out of the current contract, you should talk to your existing provider to see if you can get a better deal.

Simply call your provider and let them know about a deal that you have seen and that you are thinking of leaving the current contract, typically they will try their best to keep you on board.

Get cheap insurance for your new gadgets

If you found top-end gadgets under your Christmas tree, you should make sure to keep them safe. Check what is covered by your home contents insurance, when it will and will not pay you. If your new gadgets are not covered for damage, loss or theft you may need extra protection.

You can consider getting cheap mobile insurance through a third party insurance provider or even get it included with your bank account.

Exchange Any Unwanted Gifts

Exchanging your gift does not mean that you are ungrateful because it is always lovely to receive gifts. However, you may receive a present that is of no use for you. The first thing to do is think about how you can make use of such presents. For example, if someone gives you a jumper that you do not like, you can keep it and wear it while cleaning to avoid bleach stains on your favourite dress.

But if you cannot find any use for that unwanted present, it is time to think about selling it. You may find some guides on selling your clothes online or get the maximum money through eBay, but you can also go to the Facebook marketplace or sell it directly to a friend.

Alternatively, it can also be possible to get a refund from the place where this present was bought. Most shops take back the present only if they are faulty but if you have a receipt they will probably refund the money or allow you to exchange it. You should check the returns policy and understand consumer rights to know whether you can return something or not.

Start Planning Your Holidays

The back to work blues can be hard so it’s great to start planning and saving now for holidays abroad or festival fun.

If you continuously save money, you should never get out of budget and can enjoy each event. You can save money for your holidays and would not miss the extra cash. Do not think that it is too early to look for cheap travel deals as it is January – be mindful that the best ones sell out first so if you find a cheaper deal do not let it slip through your fingers.

Use cash back site when you buy

If you are not already using cashback sites it is worth considering. By using such sites for online shopping you can save money and it is not difficult to do. When you buy things through these websites you can get cash back on your purchases from famous brands and even cash back at the supermarket.

Always check for deals and discount codes

Along with searching for cashback on your shopping, it is also beneficial to look for better deals elsewhere and for discount codes before making any purchases.

If you think that you did not put a lot of effort into finding the best deals last year, it is the perfect time to make a change. It may take a long time looking around for a better deal but it could help you in saving money this year.

The same thing applies when you are thinking of eating out. Restaurants also offer discounts that are also advertised online. You must take a look at these deals before going out for a meal. You can get this information about such deals on Facebook pages of restaurants.

It might be hard to set up a new year’s resolution and keep up with your targets. The typical time period for which people follow their resolution is about three and a half weeks. With these five goals above you can make lasting changes in your money-saving habits.

By setting your financial goals, making resolutions and sticking to them you can move towards a healthier financial future.

All the above is for information purposes only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Why is ESG important? Why should companies and investors care?

Do you ever think about why certain investments perform better than others? Why do some start-ups seem to always perform efficiently and stand out of the crowd? The answer to these questions consists of three letters: ESG. Whether you are a small or big company or an investor, the Environmental, Social and Governance reporting and investing is a framework that helps you screen investments and stay up to speed with the market.

It means that ESG not only is a framework where investors and financial institutions need to report: but it also considers the impact of a company on its customers, employees and the community. Now you may wonder why there is a need for a framework like ESG. Simply because in natural disasters like Coronavirus or climate change we have realised that we are stewards of nature rather than the master of our planet. In the light of these events, ESG has become more active: companies are responsible for accomplishing positive climate action to build a resilient and sustainable future.

What Is ESG?

By definition, ESG is a framework that reports about the impact of a company on three areas: environment, social and corporate sectors. We can say that ESG is a term that covers a broad number of responsible and sustainable financial components. It is a framework that urges companies and investors to consider environmental, social and governance factors while making investment decisions. Moreover, it also assesses which company performs on each factor E, S & G and decides if it is a sustainable investment.

The Environmental In ESG

The E in ESG represents the environmental factor and it determines how the activities of a company impact the environment and what action a company is taking to manage environmental risks. These actions can include direct operation or the supply chain. For example, use of energy, natural resource conservation, treatment of animals and greenhouse emission.

The Social In ESG

The social (S) in ESG is a criterion that looks into the business relationships of a company. It includes the strengths and weaknesses of a company and how it makes and manages the relationship with its customers, employees, suppliers and the community. For example, these criteria include health and safety of employees, working conditions, employee relations, working conditions and diversity.

The Governance In ESG

The Governance (G) in ESG deals with the leadership, executive pay, internal controls, stakeholders rights and audits of a company. Investors may want to know if they can trust the company and whether the company is using transparent and accurate accounting methods. It can also include gender equity, political contribution, corruption and bribery.

Investors should keep in mind that not all companies can pass every test in each category, so investors should do the research and decide what is important for them.

Why we should care: The importance of ESG for companies and investors

The ESG investing practice started in the 1960s and evolved from socially responsible investing (SRI), which eliminated stocks and the whole industry from investments related to business operations like guns, tobacco and entities from the prohibited regions. Now, most investors have awareness about ESG factors and they incorporate these into the investment process. As a result, ESG is evolving and growing at a fast pace.

In addition, the European regulatory authorities are emphasising the implementation of ESG in financial and other sectors. The ESG factors are pushed into Europe because it is a framework that not only ensures the implementation of a sustainable economy but also supports the green deal.

Implement ESG to create value?

European investors have contributed €120 billion into sustainable investment options since 2019. This shows that something interesting is stirring. Investors and Venture Capitalists are highly interested in how start-ups are getting into sustainable finance and scoring on the ESG practices and policies. There is a lot of pressure to implement ESG now for example, if you want to start a new business and are looking for funds, investors very much now look at ESG to see what companies are doing.

It has been seen that the companies that implement ESG practices have better financial growth and optimisation, excellent productivity, lower volatility, lower legal and regulatory interventions, cost reduction and top-line growth. In contrast, the companies having poor performance on ESG noticed a high capital cost and high volatility due to several incidents such as fraud accounting, governance irregularities and labour strikes. So you must implement ESG factors in your company if you do not want to be left behind.

Is ESG inevitable?

Over time there is an increase in the awareness of ESG factors and chances are that they will become mandatory or compulsory. The companies who want to stay ahead of the competition and want to get the benefits of ESG must implement this framework into their company processes. In other perspectives, the companies that do not comply with the social or environmental factors may find it challenging to deal with the legal or regulatory issues at later stages.

What is the best course of action?

The best course of action is to follow the procedures that demonstrate ESG and sustainability. You can start it at any time and it is not difficult to integrate ESG from the start. If you start it now you can contribute to the generation of businesses that are more concerned about the welfare and health of their community and can impact in a positive way.

Why should we care about ESG?

We believe that the implementation of ESG helps investors to earn risk-adjusted returns by creating investment value and lowering investment risks. Thus a responsible company that cares about its customers, people and environment is always likely to demonstrate a higher level of resilience than the one that does not.

ESG analysis provides a detailed insight into factors that can affect the financial metrics of a company and help investors in making informed decisions.

Interested in further comment? Our Head of Operations, Laura Hetherington, was interviewed recently by P2PFN on the ESG focus for 2022. Read more about it here.

Open banking reaches 4.5m milestone on four-year anniversary

Copy the link below if the Read More link expires. Copy the link below if the Read More link expires.