Kuflink’s New features for March 2021. Stand Up with CTO

Allow me to quote Tony Hsieh, from Zappos, who said that “Zappos is a customer service company that just happens to sell shoes”. This is something that has stayed with me all my life and it is refreshing to find like minded people in the Kuflink family. Tech stop everything the moment we have an issue that is affecting a clients experience on the platform. It is this commitment that the CEO drives in all of us in the daily stand ups for the whole company and in our team stand ups. Our shining light, Lisa, is an embodiment of this in our Investor Relations team.

Bit of fun (We have uploaded a video showing our code commits over the last few years)

What’s New on the Kuflink Platform for March 2021

1) A new “Loan Status” column in your Portfolio section, showing each status (E.g. “Performing”, “In Default”, etc.) of all Select Invest live loans;

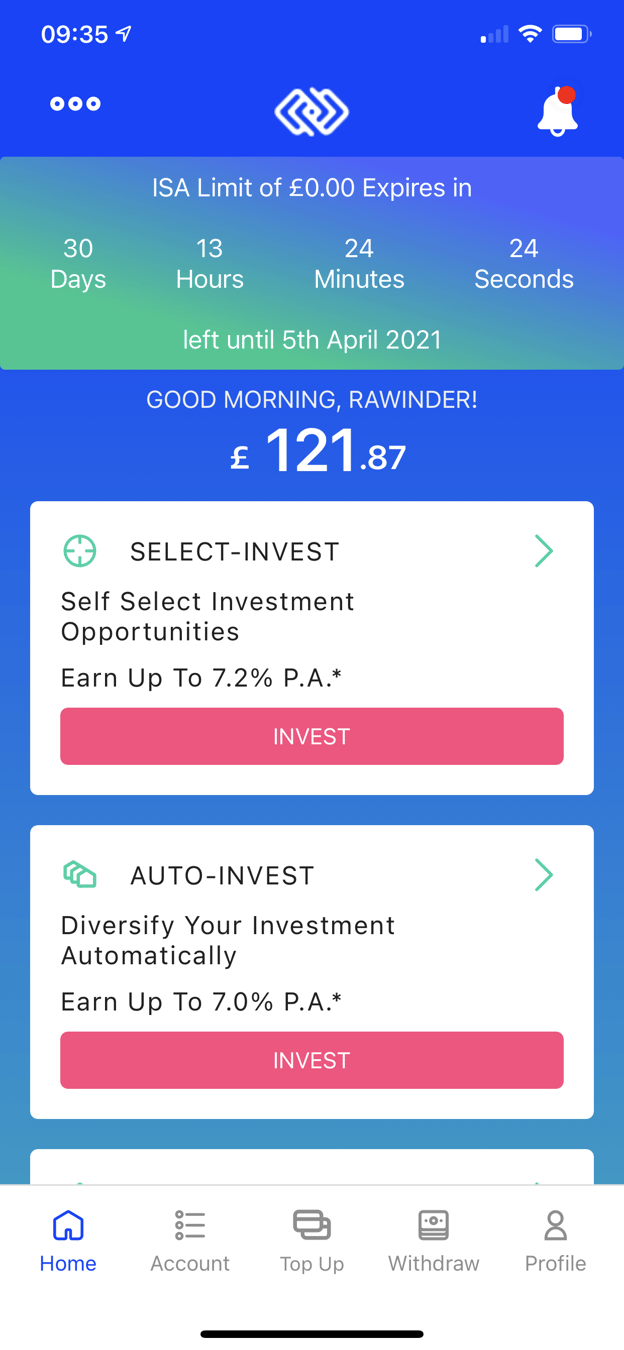

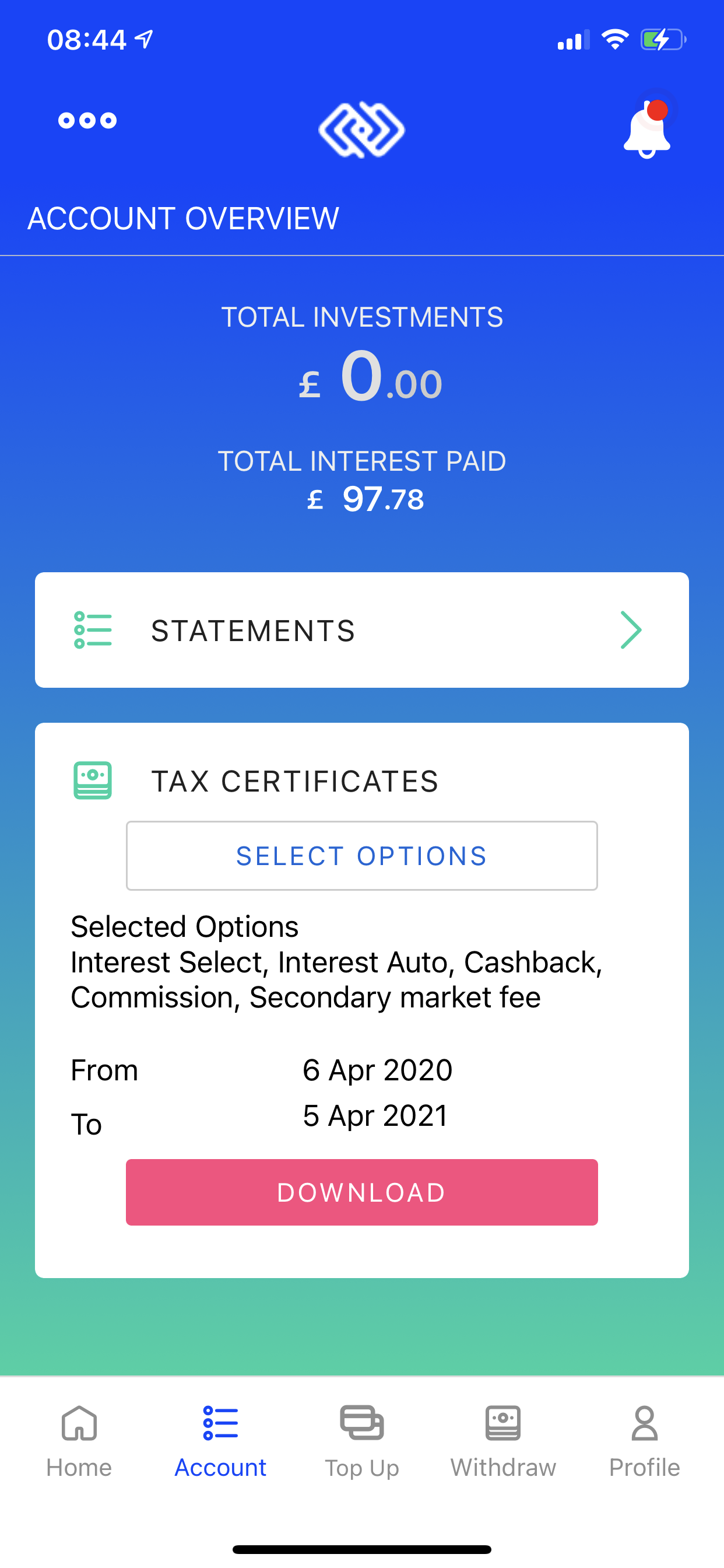

2) Kuflink Mobile App (Beta) Fixed on the Apple Store

I am happy to report that the “Kuflink Mobile App” is up and running and has launched on App stores for Android and Apple phones as a new “Beta Version”. We are constantly adding some of the new features you see on the Web Invest platform on an ongoing basis and releases will be scheduled at different times to the Web Invest Platform upgrades.

Some Updates on the New Features that have the green light and are coming soon!

1) We have started works on providing an IF-ISA wrapper around some of our Select Invest Deals – development has started – release date in the next few weeks;

2) We are working on showing updated Images and information of our Development Loans – development has started – release date in the next few weeks;

3) A new search feature on Live deals in Select Invest – development has started;

4) Pool to show ribbons which indicate which loans are in default or performing;

5) IF-ISA Transfer IN Sign up process to be digitised is now ready for end to end development and release in the next few weeks;

6) Connect to our Open Banking App, which then means we do not require an uploaded bank statement, and gives the ability to make bank transfers in real time – development has started;

7) A New segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started – release in the next few weeks; and

8) Much more.

Kuflink Algorithms

It has been a sad week where we have seen another Peer to Peer platform (House Crowd) going into administration. Reading through their reviews we can see that there seems to be common cracks such as those presented by Lendy.

We have been a bridging company since 2011 and allow this part of the business to continue the platform’s debt collections. In our algorithms and statistics page, we do not follow the recommended FCA default definition of 6 months before a deal goes into default, but rather follow our Kuflink Bridging default definition of 1 month after a payment (interest and/or capital) is due. We, in fact, have triggers to alert the teams in advance of these dates.

The key answers are due diligence (by experienced underwriters), RICs appointed valuers, strong credit committee(s), minimum 2 solicitors appointed by the Solicitors Regulation Authority (SRA), Directors getting involved in site visits, early debt collection markers, and much more.

For those affected we express our warmest prayers!

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF-ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

Kuflink introduces new tax tool and teases app launch

Copy the link below if the Read More link expires.

Kuflink CEO in conversation with Laurence from Financial Thing

We never turn down the opportunity of connecting with our community and so, our CEO Narinder Khattoare, did an online interview with Financial Thing. The conversation was live on YouTube and there were questions coming in from people watching along with questions from Laurence.

The Financial Thing blog is an unbiased Peer to Peer Lending Reviewer and DIY Investor. He has reviewed Kuflink for the last 3 years, and has awarded Kuflink a 4 star (out of 5) on 28th January 2021.

Let’s look at some of the topics covered by Laurence and Narinder’s Live Stream.

- Kuflink started as a short term bridging lender back in 2011 and we have grown rapidly since then, we started with loans of around £50k and when Narinder joined in 2013 the plan was to grow this further and have loans in the region of £250k-£300k.

- The founders of the business have many years experience in property development but it is good to have a mix of experience within the business. Narinder comes from the alternative lending market and has also worked in the insurance industry, Nattalie has 30 years of banking experience and sits on the credit committee and also heads up the Collections team, Pete brings a lot of property development knowledge (also on credit committee) and we have John in the business who is a RICS surveyor and he also sits on one of the credit committees.

- We have a strong vetting process for all the deals we do and have two credit committees, one on the origination side of the business and one on the peer to peer side. The peer to peer committee will vet all the deals before they go onto the platform for our investors.

- Kuflink interest rates have always been fairly standard in the market with an offering up to 9.13%*. We have seen many companies crash because they promised double digit returns to investors which for us is just not feasible, we have no plans to either increase or decrease our rates at the moment.

- Kuflink’s goal always has been to do something different from the competition. We are always the first ones to invest and the last ones to leave the deals. We support our investors all the way.

- We have had some investors where their money is held in deals for longer than first anticipated but we do our best to ensure that no one loses their money.

- We are always looking for ways to improve our service and welcome the feedback we get.

It’s been overwhelming to see the support we got from the viewers. We got to answer so many questions and received a lot of love and support. Head over to Financial Thing YouTube channel to watch the video.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

How would Bank of England’s negative interest rates affect you as a saver?

The Bank of England is an esteemed institution. Since its foundation in 1694, the interest rates have never been negative.

However, according to the latest news from Threadneedle Street’s quarterly monetary policy report (February 2021), building societies and banks have been given 6 months to get prepared for the likelihood that the interest rates may fall below zero.

We understand as savers you may have many concerns regarding how such decision by the Bank of England is going to impact your finances. Let’s address those concerns today!

Everything You Need to Know About Negative Interest Rates

Negative interest rates mean that the borrowers will be credited interest instead of them paying it to lenders. So, rather than getting interest on the money held at the Bank of England, local banks will have to pay to keep their cash in the central bank.

The Bank of Japan, European Central Bank, the Danish central and Swiss banks charge commercial banks to deposit money. This way, the banks cannot hoard money. They have to lend it to each other, businesses and consumers, hopefully boosting the overall economy.

How will negative interest impact the savers?

Unfortunately, negative interest rates bring more misery for savers. Ever since the start of COVID-19 interest rates on savings accounts have plummeted and the NS&I backed by government has dropped returns. A negative base rate means more accounts will be paying 0% or a bit above that, so, the value of deposits will further become damaged by inflation.

Further, wealthy savers may have to pay a charge for holding large amounts of funds on deposit. UBS charges wealthy clients a charge for saving more than £438,000 and is reportedly planning on lowering this threshold later in 2021.

Also, this means that banks may charge a fee to current accounts as well. HSBC has announced that with low-interest rates it may introduce a fee on its accounts.

Will There Be an Impact for The Borrowers?

Personal loan interest rates are low and usually fixed once you take the loan out, so the negative interest rate won’t affect your repayments. Typically, the credit card rates are lower for new customers. Still, they increase far above the base rate once the introductory period is over. So, it won’t be anywhere close to dropping into negative territory.

How negative interest rates affect mortgages?

If you have a fixed-rate mortgage you will face no interest rate cuts. The majority of people have this kind of deal, in recent times, almost nine out of ten new mortgages are taken on a fixed rate.

But, if you have a variable-rate mortgage, or a mortgage that is linked to a lender’s standard variable rate, then the interest rates may fall a bit if the base rate get cut. However, the decrease is probably limited by terms and conditions.

For instance, the building societies will never lower the rate on tracker mortgages to below 0%. Hence, if you have taken out a tracker mortgage at the base rate in addition to 1%, then it will not go below 1%.

New mortgages might become cheaper, and interest rate are already lower for borrowers with huge deposits. The lenders may rise the limitations on new tracker mortgages, this way, the rate you pay above the base rate is more than rates on current deals. As lenders, you have to ensure that you have a lower limit in terms and conditions as you wouldn’t want to pay the borrowers who have mortgages with you.

In the end if the interest rates go negative it will affect the commercial banks funds held with Bank of England. The interest on mortgages, credit cards and overdrafts would remain positive. However, going toward negative interest is still a big step, and it would be taken only after the Bank has tried all its other options.

How should investors react?

If the negative interest rates are introduced, the savings interest rates will drop, which means investing your money would become a better option than keeping it in the Bank for earning interest.

If you are thinking about investing your money, there is no better option than the peer-to-peer industry. Investing in Peer-to-Peer loans is much more transparent. At Kuflink, we allow a minimum investment of as low as £100. Even inexperienced investors can invest and reap the benefits. Plus, with the Innovative Finance ISA, you don’t have to pay tax on the interest you earn through peer-to-peer lending.

Overall, the prospect of negative interest is controversial. These rates may make approval of loans easier and may lead people to make diverse investments. We are still uncertain if these rates will be implemented or not. But as we have mentioned, it may present investment opportunities for you.

How negative interest rates affect Investments in P2P?

Affluent savers will be concerned, as the fear of charges will begin to creep in. This could be a time where we see a positive sharp increase in investment, as those savings will be best suited to an encouraging return, found outside of your bank.

One could assume that with the decrease in rates, there will be a spike in both demand and price for property in the UK. This is in part, true.

Demand will increase as those looking and ready to buy will be enticed with very low rates. However, with the unemployment impact we’re seeing to the £25,000-£50,000 income earners; prices are likely to remain steady.

The successful roll out of vaccinations throughout the UK give the Bank of England an encouraging vision for the second half of 2021. As they anticipate a reduction in lockdown restrictions, which will see the anticipated increase in consumption and economic activity.

Should they need to, the tool of negative interest rates can act as a positive catalyst for the economy through the benefits which follow an increase in investment, as savers look to get their money out of the banks and invested.

This could be a positive tool to springboard the re-opening of the economy in 2021.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

Kuflink’s New features for February 2021. Stand Up with CTO

I am reminded of a remark from the late Steve Jobs, “A Small team of A+ players can run circles around a Giant team of B and C players”. The CEO has ensured that the team is small, but filled with A+ players in all departments. We have taken the same approach in our Tech department, to ensure our platform over delivers on our clients desires.

What’s New on the Kuflink Platform for February 2021

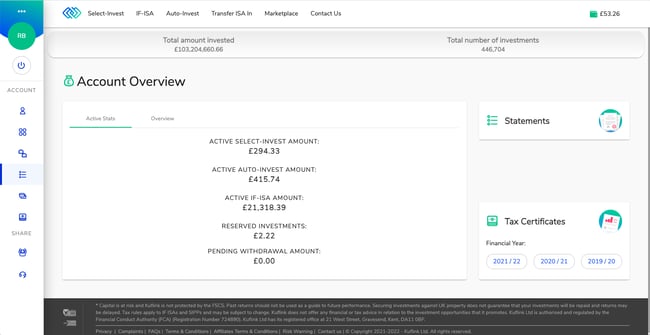

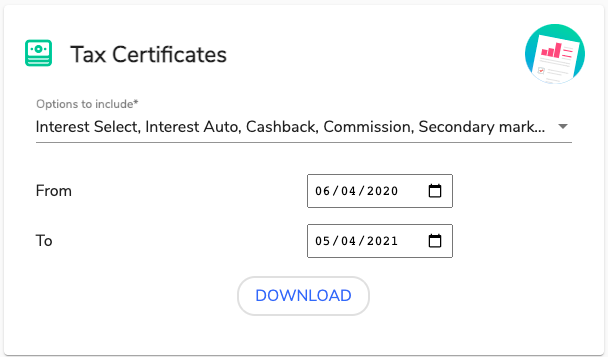

1) Our Main release for February is a versatile new Tax certificate Tool for our UK and Global clients. You can find this feature by clicking the Wallet balance (Top right of the platform) or in the Account Overview section.

Please see our Knowledge base on how to use the tool : Tax Certificate Tool – Interest and claiming tax relief on unpaid loans.

2) Mobile App Fixed on the Apple Store – (Beta – release date next week)

I am happy to report that the Mobile App is up and running and is going through final tests before Beta release on 12th February 2021. We are adding some of the new features on the Web Invest platform too.

3) The Statistics page has been linked to our Proprietary Loan management system to allow seamless updates of the current and historic loans performance;

Some of the New Features that have the green light.

1) We have started works on providing an IF-ISA wrapper around some of our Select Invest Deals;

2) We are working on showing updated Images and information of our Development Loans;

3) A new search feature on Live deals in Select Invest;

4) A new “Loan Status” column in your Portfolio section, showing each status (E.g. “Performing”, “In Default”, etc) of all Select Invest live loans;

5) IF-ISA Transfer IN Sign up process to be digitised – to speed up the process;

6) Connect to our Open Banking Application, which then means we do not require an uploaded bank statement, and gives the ability to make bank transfers in real time;

7) A New segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features); and

8) Much more.

The atmosphere on the Stand Up’s is electric. The guys are excited as Tech Development works have been producing some great feedback from you. The whole team is humbled and really appreciates your comments. As always we will endeavour to push the boundaries and continue to serve at your pleasure.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF-ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.